MARSH CUBED

The Marsh Cubed Platform empowers our clients by enabling them to manage their Regulatory Obligations and thereby reduce their Regulatory Risk.

The Company

Marsh Cubed is an exciting new Irish technology company founded in 2020, which provides comprehensive and reliable Workflow based software solutions for Regulatory Compliance for its clients in Financial Services. The company has arisen out of the growing need to provide innovative Software Solutions (with Customisation), increase process automation, digital transformation, and easy Regulatory Compliance Oversight to businesses in an increasingly regulated working environment. The Marsh Cubed Solution provides tailored workflow solutions for the Central Bank’s "Fund Management Company Guidance (CP86)", as well as the Central Bank "Individual Accountability Framework Act 2023".

The Challenge

Since the Global Financial Markets crash of 2007 a raft of Regulatory changes were introduced in many countries, which led to a significant demand for regulatory technology (“Reg Tech”) to ensure that financial institutions are in full compliance with new and fast changing Regulations. Where a financial institution is operating on an international scale, sometimes extremely complex Regulatory scenarios arise, as Regulatory Compliance must be simultaneously ensured and satisfied in several different jurisdictions. Thus, Reg Tech has become very important in the Financial Services industry in recent times. There are relatively few companies developing high quality Software Solutions in the Reg Tech sector, which provides Marsh Cubed with an unprecedented opportunity to sell its system to Financial Services companies, and more particularly on an International scale.

Corporate Governance is a large concern for Fund Management Companies (ManCos), and it is a sector that is very highly regulated, especially since the introduction of the Fund Management Company Guidance in 2018 and the Individual Accountability Framework Act in 2023. A person in a Controlled Function (CF) role (which includes Designated Persons, Executive Directors and Non-executive Directors) can be investigated by the Central Bank up to six years after they formerly held a Controlled Function. It is important for the individual in a CF role to be able to provide evidence of the actions they took to prevent a statutory investigation which could be time consuming and significantly detrimental to their career. Most companies track the process of decision making and escalation through manual processes using spread sheets and e-mails which is very labour intensive. The Marsh Cubed solution includes a Matters Arising Manager and Escalation Manager to provide evidence to support the actions taken by individuals which is crucial to support an individual’s actions in any investigation by the regulator.

Software Solutions

The Marsh Cubed Platform is comprised of a full suite of Software Solutions, built to empower our clients by enabling them to manage their Regulatory Obligations and thereby reduce their Regulatory Risk. Our system is highly intuitive, “user-friendly”, stable, and reliable. The increased automation of processes provided by Marsh Cubed relieves our clients from the everyday burden of manual Regulatory implementations currently used by so many companies and institutions in the Financial Services Sector. The Marsh Cubed Solution systematically collects and centralises all required data to ensure Regulatory Compliance. The Solution may be deployed either as a Standalone Solution, or alternatively integrated into existing Management Processes using our API Interfaces. While our Solutions are primarily designed to cater for the Financial Services sector (in particular Fund Services), our software can be easily configured and adapted to perform Regulatory Compliance in other sectors. As the product has been developed as a “Web Application”, it can be easily access by any Web Browser.

Workflow Solution

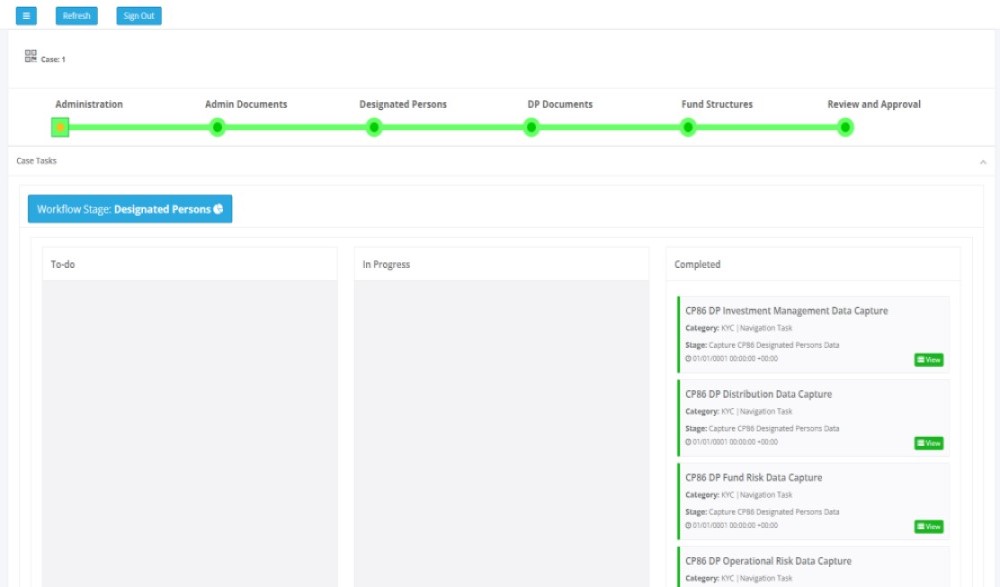

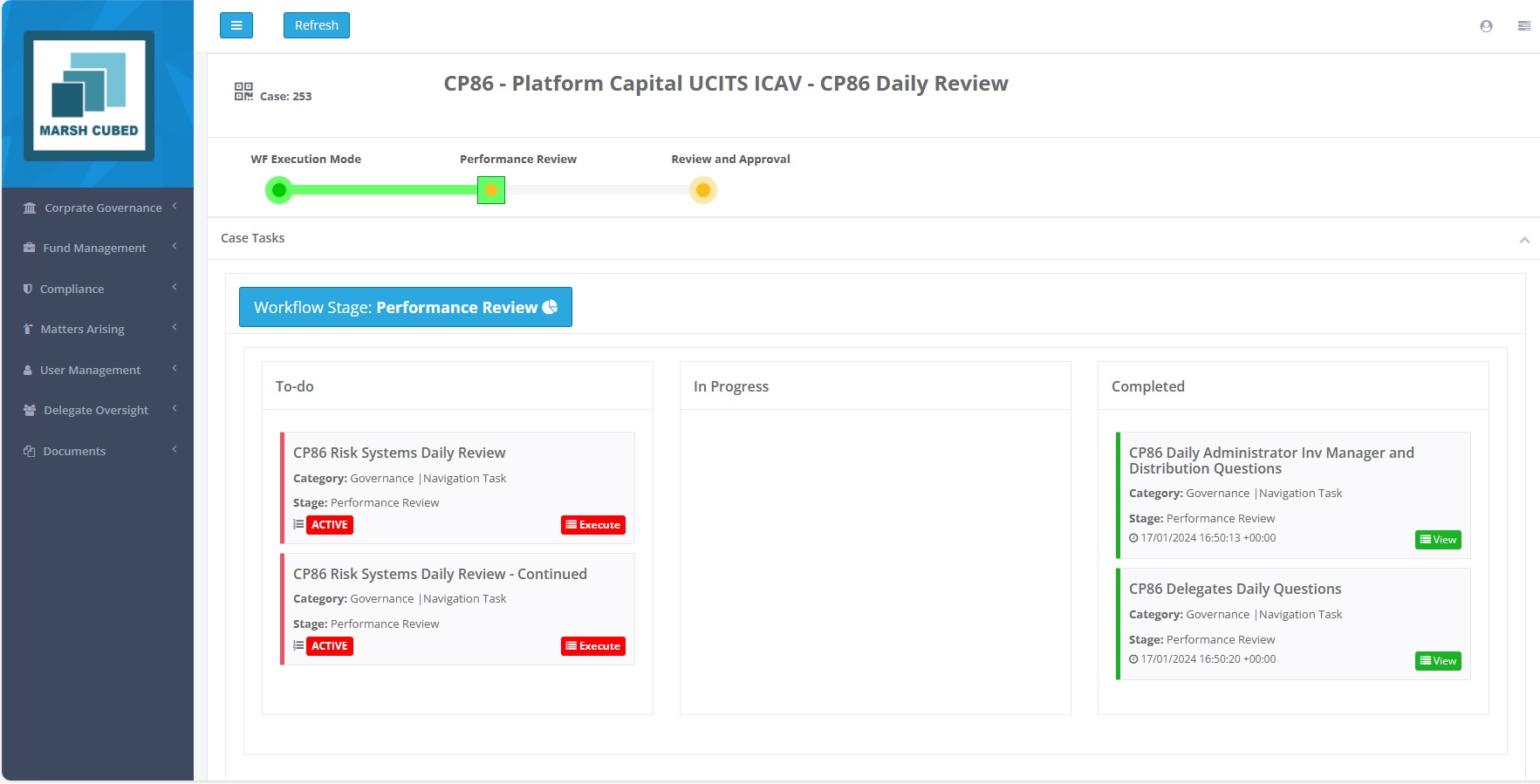

At the heart of the Marsh Cubed system is the bespoke Workflow Engine, developed from the ground up by Marsh Cubed, and tailored specifically to meet the Regulatory Requirements and needs of the Financial Services industry. With that said, as the Workflow Engine is a propriety Marsh Cubed solution it can be easily adapted and configured to cater for ANY business process, whether Regulatory related or not. The Workflow Engine dynamically interacts with our Business Rules Engine (BRE). The BRE can modify Workflow tasks as the Workflow proceeds, as well as insert additional Workflow tasks depending on the data that has already been captured by the Workflow. This lends an ability of the solution to process highly complex business contexts in a very efficient way by increasing the configurability of the system, and thus significantly increases the overall operating sophistication of the product.

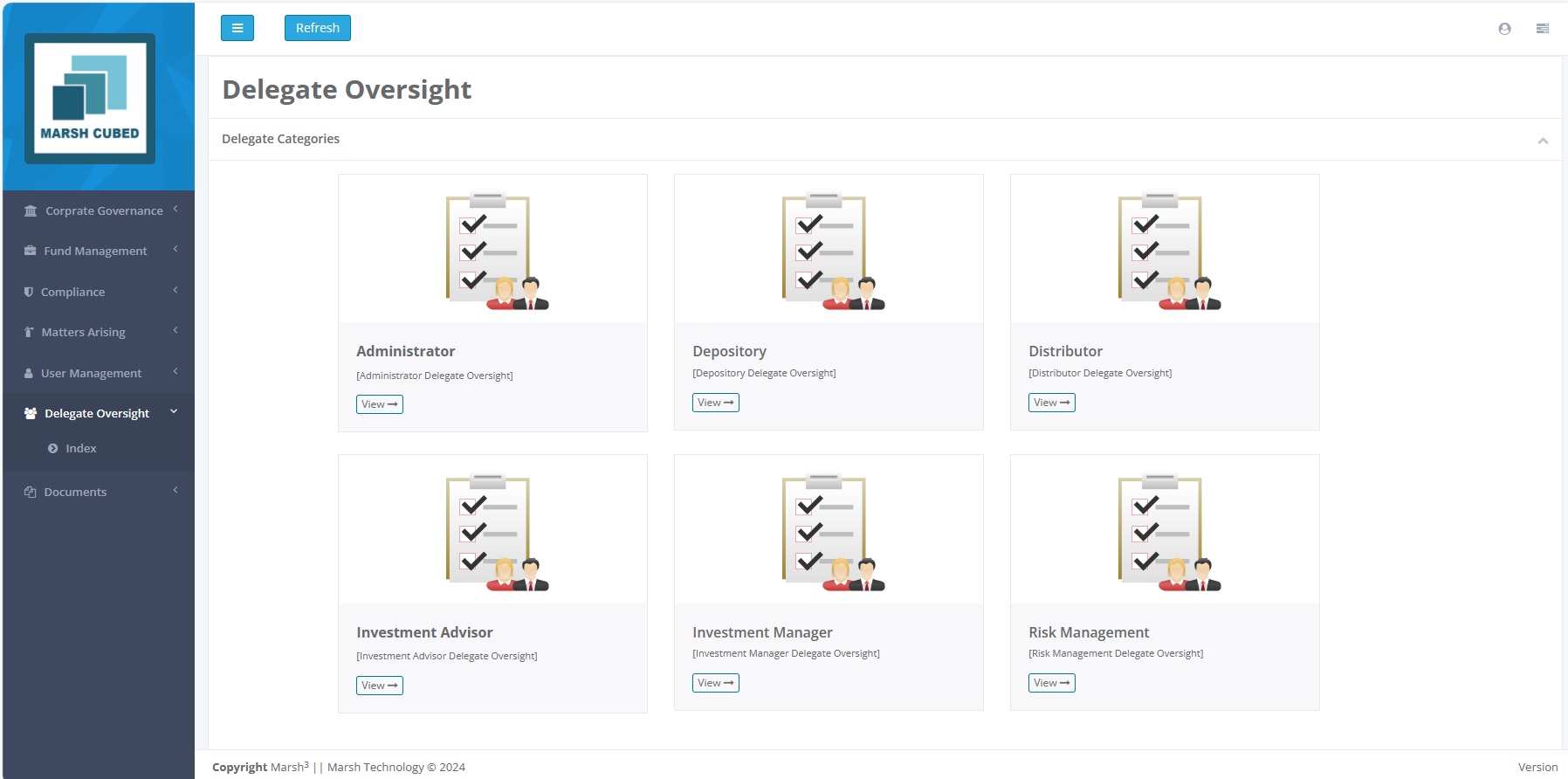

Central Bank Fund Management Company Guidance (CP86)

The Central Bank Fund Management Company Guidance (CP86) which was published in December 2016 and came into effect on 1st July 2018 is directed at Fund Management Companies (ManCos), many of which are still largely unprepared for even today. Many companies continue to manually track their Regulatory Obligations using spreadsheets and e-mail, which is inefficient, and labour intensive. The Marsh Cubed Platform incorporates a comprehensive tailored Fund Management Company Guidance (CP86) solution which automatically gathers required data from Directors and Designated Persons (DPs) at appropriate times satisfying the Fund Management Company Guidance (CP86) Regulatory Obligations. An integral component of our Fund Management Company Guidance (CP86) solution is the “Delegate Oversight” module, which formally On-Boards CP86 Delegates such as Administrators and Investment Managers, with Workflows for:

There are Daily Review Workflows that provide on-going oversight of Fund Structures, as well as individual funds. Many of these Workflows result in a RAG (Red, Amber, Green) Rating for the process involved. Price and Risk data can be streamed on to our platform from various third-party suppliers (such as Administrators and Risk Managers) on a daily basis using our API, where upon subsequent analysis any potential problems are flagged and escalated to the appropriate person (Designated Person/Fund Board) within the Company for immediate action and escalation. Such price data can be immediately and automatically published to our clients’ websites for Investors. All the collected data is stored centrally, and can thus be accessed easily and downloaded from the Marsh Cubed System. As all relevant price and risk data is physically situated on one platform, the data oversight is rendered to be a very convenient, non-time-consuming, and “unstressful“ process. . The Marsh Cubed Portal can also be accessed by external Service Providers to make regular “Attestations” that directly feed into existing active Workflows on the system, thereby saving time for Company Employees.

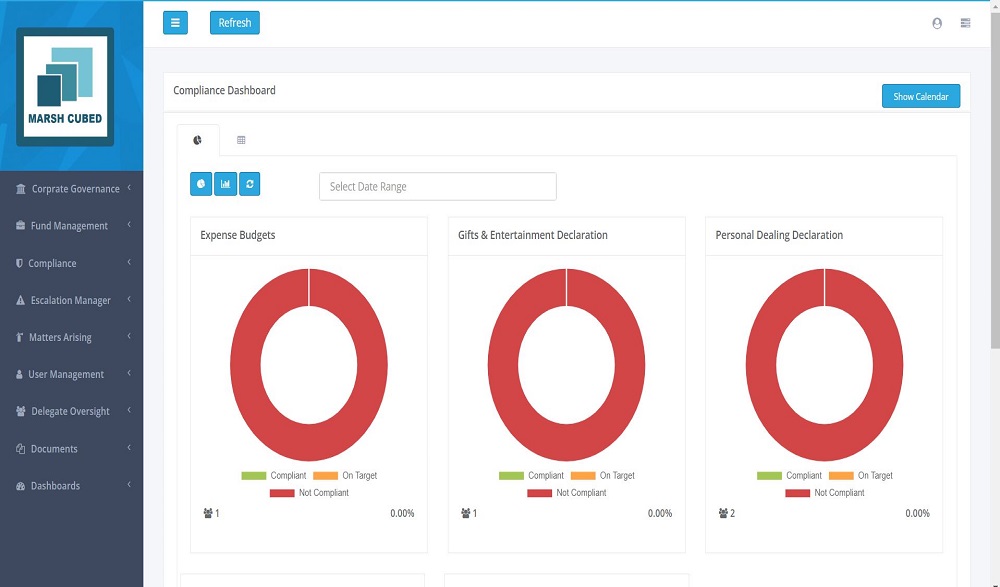

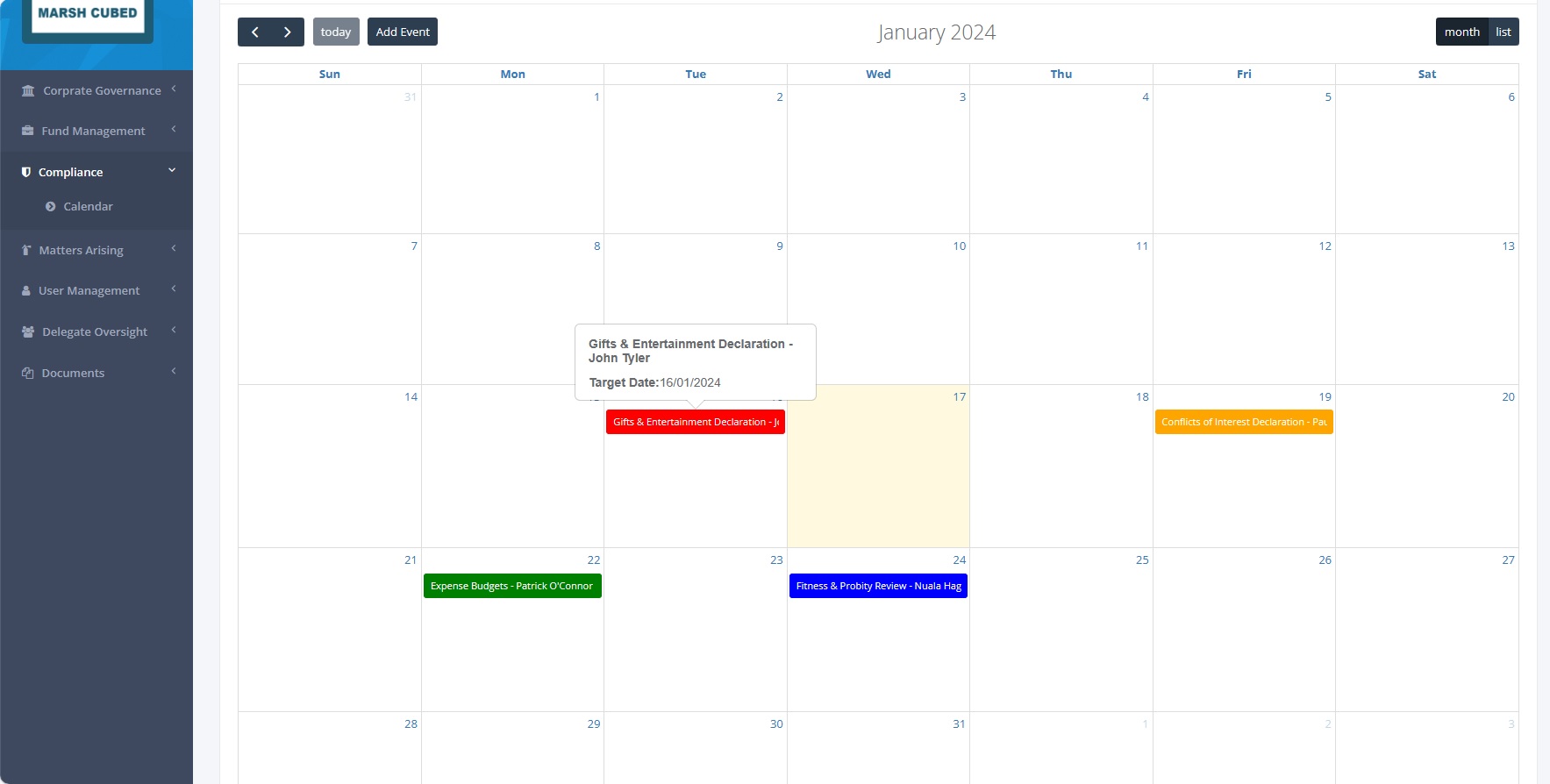

Compliance Calendar

The Compliance Calendar is a very powerful tool for Compliance Officers, Designated Persons (DPs) for Regulatory Compliance, and other such administrators to set regular individual Compliance tasks for Directors, DPs, and Employees. Such tasks include for example Fitness and Probity Declarations, Gifts and Entertainment Declarations, Conflicts of Interest Declarations. When a task is assigned to a participant, a Target Date is set for completion, and that participant will then be automatically e-mailed by the system to inform them of the new task with a convenient hyperlink to the relevant Workflow. All assigned tasks are visible on the Calendar, and colour-coded (RAG) to exhibit their current status. Completed tasks, overdue tasks, and tasks in danger of missing the Target Date are all thus immediately visible at a glance.

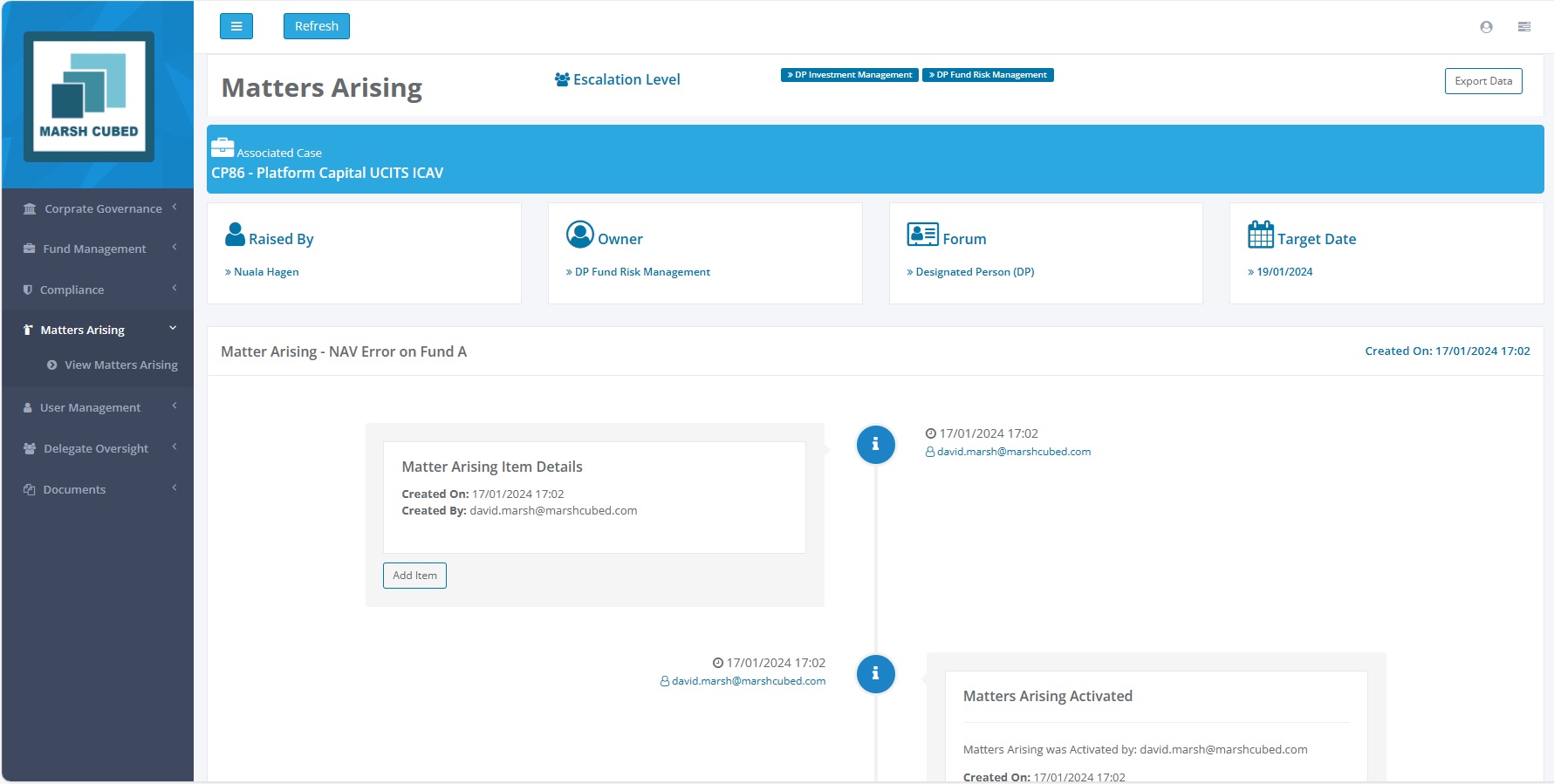

Matters Arising Manager

The Matters Arising Manager is a “problem tracker” that records on a timeline how an issue originating from a Designated Persons meeting, a Management Company Board meeting, or a Fund Board meeting, has been dealt with, and who contributed to the issue’s final resolution. In one single thread the issue is outlined, responsibility assigned to an individual (which can be changed during the evolution of the solution), and all actions taken towards that resolution, thus creating a full Audit Trail on that single issue. Supporting documents and e-mails that have been collected as part of the process may be uploaded as part of the data gathering. When a resolution of the problem has been achieved, successful or otherwise, the thread may be then be formally closed.

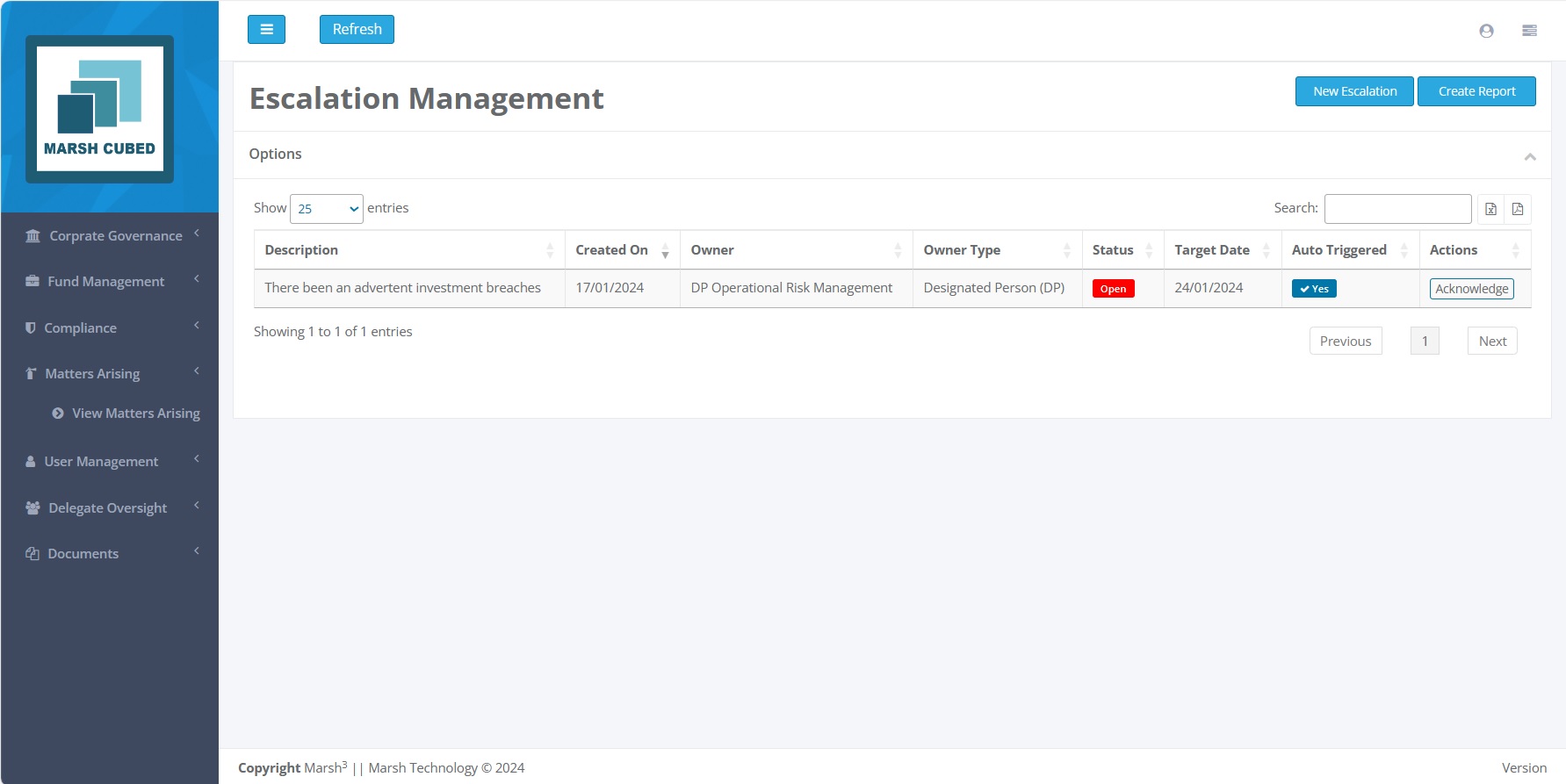

Escalation Manager

The Escalation Manager handles “Escalations”, and is very similar to the Matters Arising Manager in its working. There is, however, one major difference – Escalations can be automatically triggered and initiated by the system where a problem is detected by the system based on configurable preset criteria. When an Escalation has been initiated, the system will send e-mails to key individuals to alert them to the current Escalated situation.

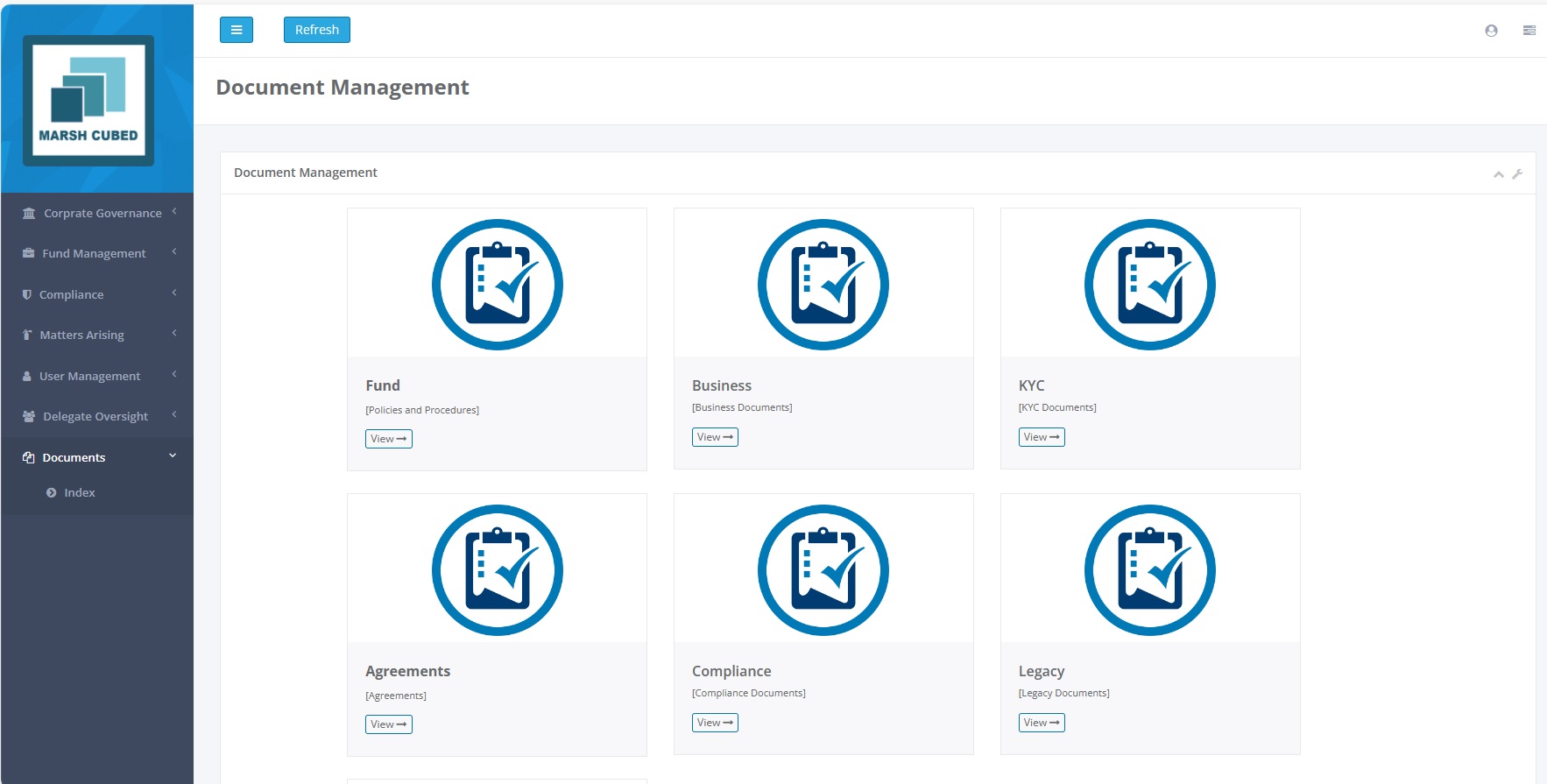

Document Repository

Marsh Cubed has an on-board Document Repository which can be synchronised with other Document Management systems such as Microsoft SharePoint. Documents can be uploaded into various Categories (or “bins”) depending on their nature (Legal, Business, Regulatory etc) for ease of retrieval. The Document Repository thereby centralises all Business Cases to one location that can be accessed by all authorised and authenticated employees within a company.

For “Techies”

Technology Stack

The Marsh Cubed Solution, as previously stated, is built as a Web Application and thereby accessed by a Web Browser such as Microsoft Edge. The Solution utilises a Microsoft Development Stack, and is built using technologies such as C#, SQL Server, JavaScript, and JQuery. The “Business Rules Engine” (BRE) is a Java based Service and accessed by the core functionality using HTTP requests. Due to the tiered architecture of the product, other Databases (such as Oracle) may easily be incorporated into the Solution if desired. Our recommended deployment is to the cloud-based Microsoft Azure – however other clouds can be used, or an On-Premises installation can be used if preferred.

Security

Security is a legitimate and overriding concern for all Financial Services Companies, and particularly regarding propriety data. Authentication and Authorisation is performed by external Service Providers such as “Auth0” or “Azure Active Directory”, who handle User Password changes and issues etc. When a User has been cleared by the external provider, they are then “double-checked” for validity internally by the Marsh Cubed System before access is finally granted. Options for multi-step Authentication (such as using SMS text messages) are also available. All User requests are protected by current commercial grade SSL Protocols and Encryption. The security of cloud-based installations are protected by Microsoft Azure. Specific Data Fields may also be protected (at the Database Level) from leaving the jurisdiction, as is Legally Required by some countries such as Luxembourg.

Contact Us

Marsh Cubed Regulatory Compliance Software